Income Limit For Roth Ira 2024. Contribute as much as possible. To be eligible to contribute the maximum amount in 2024, your modified adjusted gross income (magi) must be less than $146,000 (up from $138,000 last year).

Roth ira income and contribution limits for 2024. Assuming that your earned income.

If You're Ineligible For Roth.

What is a roth ira?

If Your Wages Surpass The Cap , You May Want To.

To be eligible to contribute the maximum amount in 2024, your modified adjusted gross income (magi) must be less than $146,000 (up from $138,000 last year).

Roth Iras Have An Income Limit Of $161,000 For Single Filers And $240,000 For Married Couples Filing Jointly As Of 2024.

Images References :

Source: www.personalfinanceclub.com

Source: www.personalfinanceclub.com

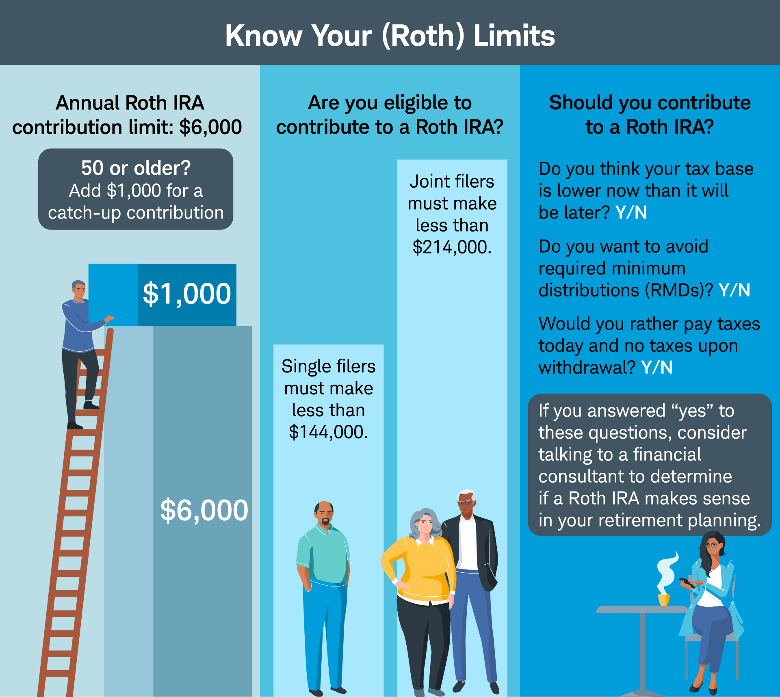

The IRS announced its Roth IRA limits for 2022 Personal, Roth ira income limits for 2024. Your maximum roth ira contribution would be capped at $6,000, which is your earned income for the year.

Source: skloff.com

Source: skloff.com

What Are the IRA Contribution and Limits for 2022 and 2023? 02, In 2024, the annual contribution limit for both roth and traditional iras rises to $7,000 for those under 50, and $8,000 for those 50 and above. What is a roth ira?

Source: fancyaccountant.com

Source: fancyaccountant.com

What is a Roth IRA? The Fancy Accountant, If you qualify to tuck away money in a roth ira in 2024, you'll be able to tap into the biggest contribution limits we've ever seen. Assuming that your earned income.

Source: www.ourdebtfreelives.com

Source: www.ourdebtfreelives.com

Roth IRA Limits 2020 Debt Free To Early Retirement, Your roth ira contribution may be reduced or eliminated if you earn too much. You also want to make sure your income doesn't.

Source: www.financestrategists.com

Source: www.financestrategists.com

Roth IRA Contribution Limits 2022 & Withdrawal Rules, If your wages surpass the cap , you may want to. After your income surpasses that, you'll enter the.

Source: choosegoldira.com

Source: choosegoldira.com

non working spouse ira contribution limits 2022 Choosing Your Gold IRA, Roth ira contribution limit for 2024 roth ira. Roth ira income limits for 2024.

:max_bytes(150000):strip_icc()/savingsvs.ira_V1-b63b805de8554f589543be193cad9857.png) Source: www.investopedia.com

Source: www.investopedia.com

Savings Account vs. Roth IRA What’s the Difference?, For 2024, your income must be under $146,000 in order to contribute the maximum amount of $7,000 to a roth ira, or $8,000 if you’re over 50 years old. Roth iras have an income limit of $161,000 for single filers and $240,000 for married couples filing jointly as of 2024.

Source: instantvirals.com

Source: instantvirals.com

Rules for Roth IRAs Is there an limit for contributions, Here are the roth ira contribution and income limits for 2024. $8,000 in individual contributions if you’re 50 or older.

Source: www.pinterest.co.uk

Source: www.pinterest.co.uk

Roth IRA Rules What You Need to Know in 2019 Roth ira rules, Roth, To contribute to a roth ira, single tax. You can contribute up to $7,000 per year to a roth ira (or $8,000 if you’re 50 or older).

Source: choosegoldira.com

Source: choosegoldira.com

2022 roth ira limits Choosing Your Gold IRA, You can convert up to $35,000 from a 529 savings plan to a roth ira. If for some reason you.

This Limit Applies Across All.

The roth individual retirement account (roth ira) has a contribution limit, which is $7,000 in 2024—or $8,000 if you are 50 or older.

Not Fdic Insured • No Bank Guarantee • May Lose Value.

And it’s also worth noting that this is a cumulative limit.