Irs Payment Extension 2024. How to file for a tax extension in 2024. If you expect to owe money, it is recommended that you send a payment by april 15 to avoid interest and other penalties.

Subscribe to irs tax tips. Make a payment today, or schedule a payment, without signing up for an irs online account.

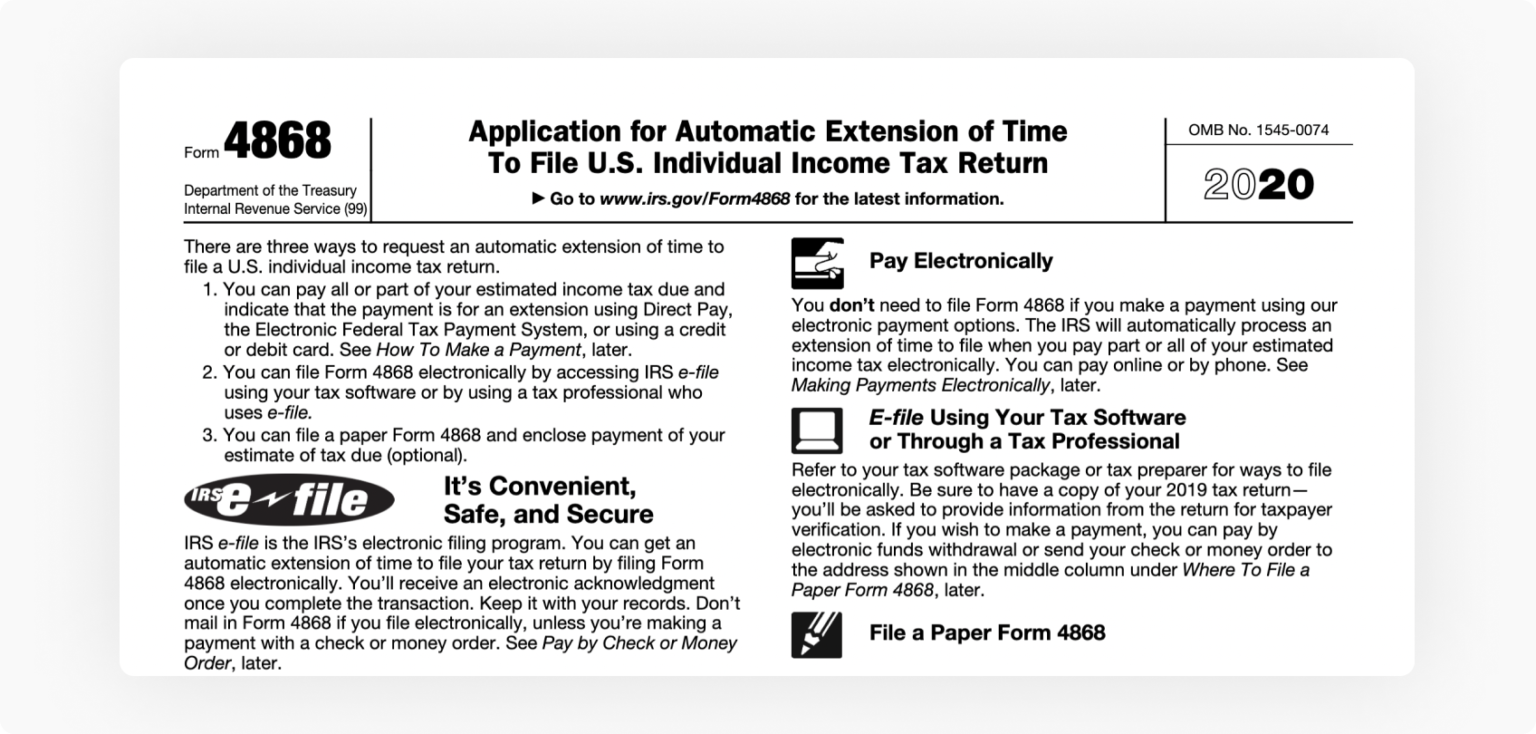

There Are Three Ways To Do It.

If you haven’t filed yet, you should file timely to avoid possible penalties and interest.

Pay From Your Bank Account, Your Debit Or Credit Card, Or Even With Digital Wallet.

Requesting an extension of time to file.

How To File For An Extension In 2024.

Images References :

Source: suzannewmarjy.pages.dev

Source: suzannewmarjy.pages.dev

Irs Payment Extension 2024 Henrie Steffane, Page last reviewed or updated: Do that, and the due date for your 2023 federal return is pushed back to oct.

Source: geraldawlori.pages.dev

Source: geraldawlori.pages.dev

Irs Tax Filing Extension Deadline 2024 Greer Shanda, If you can't file your federal tax return by the april 18, 2023, deadline, request an extension. Do that, and the due date for your 2023 federal return is pushed back to oct.

Source: johannahwtory.pages.dev

Source: johannahwtory.pages.dev

Irs Tax Extension Form 2024 For Business 2024 Almira Marcelia, How to file for an extension in 2024. How to file for a tax extension in 2024.

Source: suzannewmarjy.pages.dev

Source: suzannewmarjy.pages.dev

Irs Payment Extension 2024 Henrie Steffane, Taxes owed are due by the original tax deadline, typically april 15. You can request an extension for free, but you still need to pay taxes owed by tax day.

Source: lannaqdeloris.pages.dev

Source: lannaqdeloris.pages.dev

Irs Deadline Extension 2024 Avie Melina, What happens if i miss the. Does the tax extension deadline apply to me?

Source: teenaqwalliw.pages.dev

Source: teenaqwalliw.pages.dev

Free Irs Tax Extension 2024 Shirl Marielle, Page last reviewed or updated: If you haven’t filed yet, you should file timely to avoid possible penalties and interest.

Source: ptetdcb2020.com

Source: ptetdcb2020.com

IRS Tax Extension 2024 How To File Online & Know Eligibility, If you need more time to file your taxes, make sure to ask for it. Irs schedule for 2024 estimated tax payments;

Source: juneqadelaida.pages.dev

Source: juneqadelaida.pages.dev

Irs Tax Extension Form 2024 Pdf Tina Lorilyn, There are three ways to do it. A tax extension is a request for an additional six months to file a tax return with the irs.

Source: printableformsfree.com

Source: printableformsfree.com

Irs Tax Extension Form Printable Printable Forms Free Online, You can request an extension for free, but you still need to pay taxes owed by tax day. Be sure to mark your calendar because federal income taxes are due on april 15 for 2024.

Source: kaitlynnwcolly.pages.dev

Source: kaitlynnwcolly.pages.dev

Tax Filing Extension 2024 Irs Becka Marilyn, To get the extension, you must estimate your tax liability on this form and should also pay any amount due. Pay from your bank account, your debit or credit card, or even with digital wallet.

You Can Also Get An Extension By Electronically Paying All Or Part Of Your Estimated Income Tax Due And Indicating The Payment Is For An Extension.

What happens if i miss the.

A Tax Extension Is A Request For An Additional Six Months To File A Tax Return With The Irs.

Taxpayers in maine and massachusetts have until april 17 due to patriots’ day.